Prepaid Expenses

Content

Maybe that Facebook friend you met in college is now running a stationery business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in stationery for years and can offer invaluable insight and industry connections. Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Is stationery an asset or equity?

Stationery will be considered as an asset if someone is dealing in stationeries, while it can be considered as an expense if someone is buying it for the business.

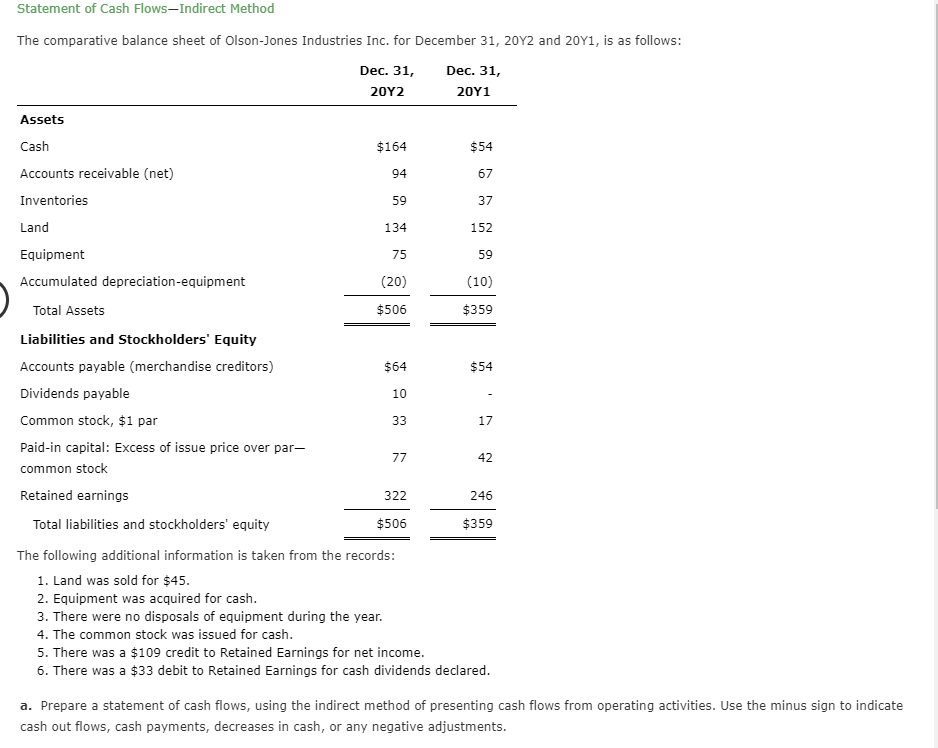

Research stationery businesses in your area to examine their products, price points, customer reviews, and what sells best. For instance, maybe the local market is missing a sympathy note stationery business. Digital stationery, cards, and invitations are growing in popularity, presenting a challenge for paper stationery businesses. This could, however, be an opportunity for a tech-savvy entrepreneur to start a digital stationery company. Floral scented stationery is increasing in popularity, presenting an opportunity for stationery businesses to utilize scents as add-ons to products for additional revenue. Cash reconciliation – This is the company’s cash balance, plus sources of funds, minus uses of funds, equals increase in cash, which accounts for the company’s total cash balance.

How Should You Classify Office Expenses?

Office supplies may or may not be acurrent assetdepending on their cost. A current Asset is anyassetthat will provide an economic benefit for or within one year. In our is stationery an asset digital age, it’s hard to believe that paper stationery is still in use – but it is! The stationery industry is worth nearly $6 billion in the United States alone.

These are not resources used up during production, such as sheet metal or commodities the business would typically sell for income during that reporting year. If you are stocking up on office supplies and buying office equipment, computers, and software as part of your business startup, you will need to keep a separate record of these costs.

Purchase refers to the buying of a stationery for

For example, a company with a small number of assets will have a lower threshold for purchases than one that has a higher number of assets. Let’s take a look at all three business expense categories and how to classify them properly. But because this involves accounting, there are exceptions to that rule. When there is an exception, it would likely fall into the office expense or office equipment category.

Office Supplies: Are They an Asset or an Expense? – The Motley Fool

Office Supplies: Are They an Asset or an Expense?.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

For a company that sells both goods and services, it is called cost of sales. A capital asset is an asset with a https://online-accounting.net/ useful life longer than a year that is not intended for sale in the regular course of the business’s operation.

PRINTING AND STATIONERY EXPENSES

The closing stock of the stationery items can be reduced from the printing and stationery expenses at the time of finalization of accounts. The cost of manufacturing supplies on hand at the end of an accounting period will be reported in a balance sheet current asset account such as Inventory of Manufacturing Supplies. In the double-entry bookkeeping system, expenses are one of the five main groups where financial transactions are categorized. Other categories include the owner’s equity, assets, liabilities, and revenue. Expenses in double-entry bookkeeping are recorded as a debit to a specific expense account. A corresponding credit entry is made that will reduce an asset or increase a liability.